does cash app report to irs bitcoin

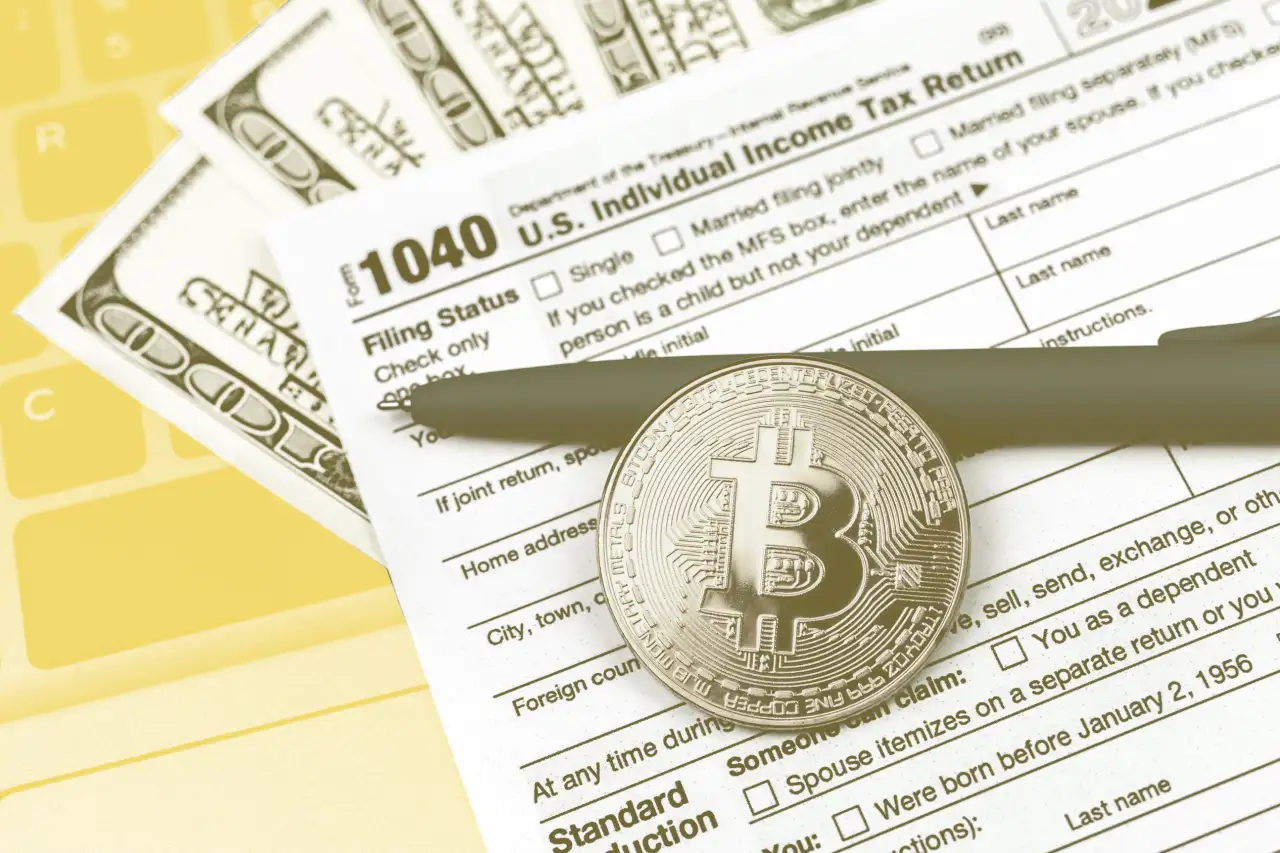

Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app. New cash app reporting rules only apply to transactions that are for goods or services.

Gold Coin Bitcoin Currency Blockchain Technology Buy Bitcoin Buy Cryptocurrency Cryptocurrency

4 easy steps to report your Cash App taxes Heres how you can report your Cash App taxes in minutes using CoinLedger.

/images/2022/01/20/bitcoin-and-cash.png)

. Tax Reporting for Cash App. If you have sold Bitcoin. 1250 PM EDT October 16 2021.

Early on pulled a 25 gain from sellingwithdrawing back to bank account. Certain Cash App accounts will receive tax forms for the 2018 tax year. If you buy one bitcoin for 10000 and sell it.

Yes the Cash app falls under the IRS. The proceeds box amount on the Form 1099-B shows the net cash proceeds from your Bitcoin sales. Beginning January 1 2022 the new federal threshold for P2P reporting is 600 down from 20000.

This means any sales made through Cash App formerly Square PayPal Venmo or other third-party platform will result in a 1099-K form next year. Beginning this year third-party payment processors will be required to report a users business transactions to the IRS if they. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually.

Cash App does not report your total Bitcoin cost basis gains losses to the IRS or on this form 1099-B. Cash App reports the total proceeds from Bitcoin sales made on the platform. Some assets such as the value of Bitcoin and stocks you have bought and sold must be shared with the IRS.

However this means that the IRS is catching up to it to wring tax money out of this lucrative market. Cash App initially released in 2013 but it did not add Bitcoin support until about five years later. Cash App does not provide tax advice.

Cash App does not provide tax advice. Cash App reports the total proceeds from Bitcoin sales made on the platform That being said the form is confusing it does have the basic. Yes you get a new bitcoin address on Cash App after each deposit.

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. CPA Kemberley Washington explains what you need to know. Cash App does not report your Bitcoin cost-basis gains or losses to the IRS or on this Form 1099-B.

As a law-abiding business Cash App is required to share specific details with the IRS. This applies to businesses and any other individuals making sales of 600 or more through a P2P. Click Statements on the top right-hand corner.

In order to calculate your taxable gains and losses please refer to your account activity history in Cash App. Cash App will send you a 1099-B form by February 15th of the following year after your bitcoin crypto sales. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds.

Does Cash App Report Bitcoin to IRS. If you sold your Bitcoin Cash you need to use capital gains treatment on Form 8949. Cash App does not provide tax advice.

2022 the rule changed. Log in to your Cash App Dashboard on web to download your forms. The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form beginning January 1 2022.

See our guide on Cash App reporting personal accounts to the IRS. If you send up to 20000 to 30000 per month Cash App is sure to share your. The American Rescue Plan includes a new law that requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS.

The new rule is a result of the American Rescue Plan. And there is no longer a transaction minimum down from 200. The 19 trillion stimulus package was signed into law in March.

See our guide on linking Cash App to Robinhood. Can You Get a New Bitcoin Address on Cash App. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS.

Click to see full answer In this regard does Cashapp report to IRS. Form 1099-K is used to report transactions for the sale of goods andor services through peer-to-peer P2P payment services like Cash App. Cash App does not report a cost basis for your Bitcoin sales to the IRS.

Cash App wont report any of your personal transactions to the IRS. Yes Cash App reports Bitcoin to the IRS for any transactions on the platform. To learn more about the 1099-B tax reporting and bitcoin visit our Support Center.

However in Jan. Im not a fan atm first go around with BTC on cash app. The IRS treats virtual currencies like bitcoin as property meaning that they are taxed in a manner similar to stocks or real property.

Your Form 1099-B is based on the information provided on the Form W-9. For proceeds enter the selling price. Does The Cash App Report To IRS.

Navigate to the Cash App tab on CoinLedger and upload your CSV file. Lets go into a bit more detail on what kinds of transactions the IRS will expect Cash App to report. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

A Bit of Background About Cash App. If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

Login to Cash App from a computer. Only customers with a Cash for. For cost basis enter the 266 Bitcoin Cash value received per unit as.

Youre automatically given a new bitcoin wallet address every time you make a transaction on Cash App. Likewise people ask does Cashapp report to IRS.

Does Cash App Report To The Irs

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Cryptocurrency News Is Crypto Good Money Sec And Initial Coin Offerings Mixing Crypto N Rewards Cryptocurrency Cryptocurrency News Initials

Facts About Monero Cryptocurrency Cryptocurrency Trading Crypto Bitcoin

Does Cash App Report To The Irs

Please Report The Bitcoin Com Wallet To The Ios App Store For Fraud Bitcoin Bitcoin Wallet Bitcoin Transaction

Taxes On Cryptocurrency In Spain How Much When How To Pay

Infrastructure Bill Cracks Down On Crypto Tax Reporting What To Know

Understanding Crypto Taxes Coinbase

Cryptocurrency News Japan S Coin Check Makes Investing Easy For Beginners Cryptocurrency Investing Bitcoin

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

/images/2022/01/20/bitcoin-and-cash.png)

How To Cash Out Bitcoin A Guide For Beginners Financebuzz

Cryptocurrency Taxes What To Know For 2021 Money

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Jack Dorsey Still Maxing Out His Cashapp Limit To Buy Btc Weekly Buy Btc Buy Bitcoin Podcasts

Do You Pay Taxes On Cryptocurrency

Does Cash App Report To The Irs

Dua Aset Defi Baru Meroket Saat Bitcoin Dan Ethereum Bergerak Ke Samping Di 2021 Aset Keuangan Investasi